Capitalization Tables for Startup Founders Part 1: Pre-Investment

“Capitalization Tables for Startup Founders” is a three part series that will help new entrepreneurs better understand capitalization tables (“cap tables”). I edited a cap table template from S3 Ventures for this series, which can be downloaded here. Thanks, S3! You can download my specific Excel template (from the video and screenshots below) here — please click the download icon rather than requesting access to the Google Drive file.

Part 1: Pre-Investment | Part 2: Convertible Notes | Part 3: Series A

Prefer video?

Regardless of your background as a startup founder, you will deal with cap tables when raising capital from investors. I strongly recommend that you have a basic understanding of cap tables before that important moment arrives.

In its simplest form, a cap table shows who owns what in a company. As startups raise money from multiple sources in numerous forms (preferred v. common stock, liquidation preferences, etc.), cap tables become more complex. Additionally, cap tables play an important role in a what-if analysis when evaluating financing options.

Let’s dig into the basics.

Pre-Investment Cap Table

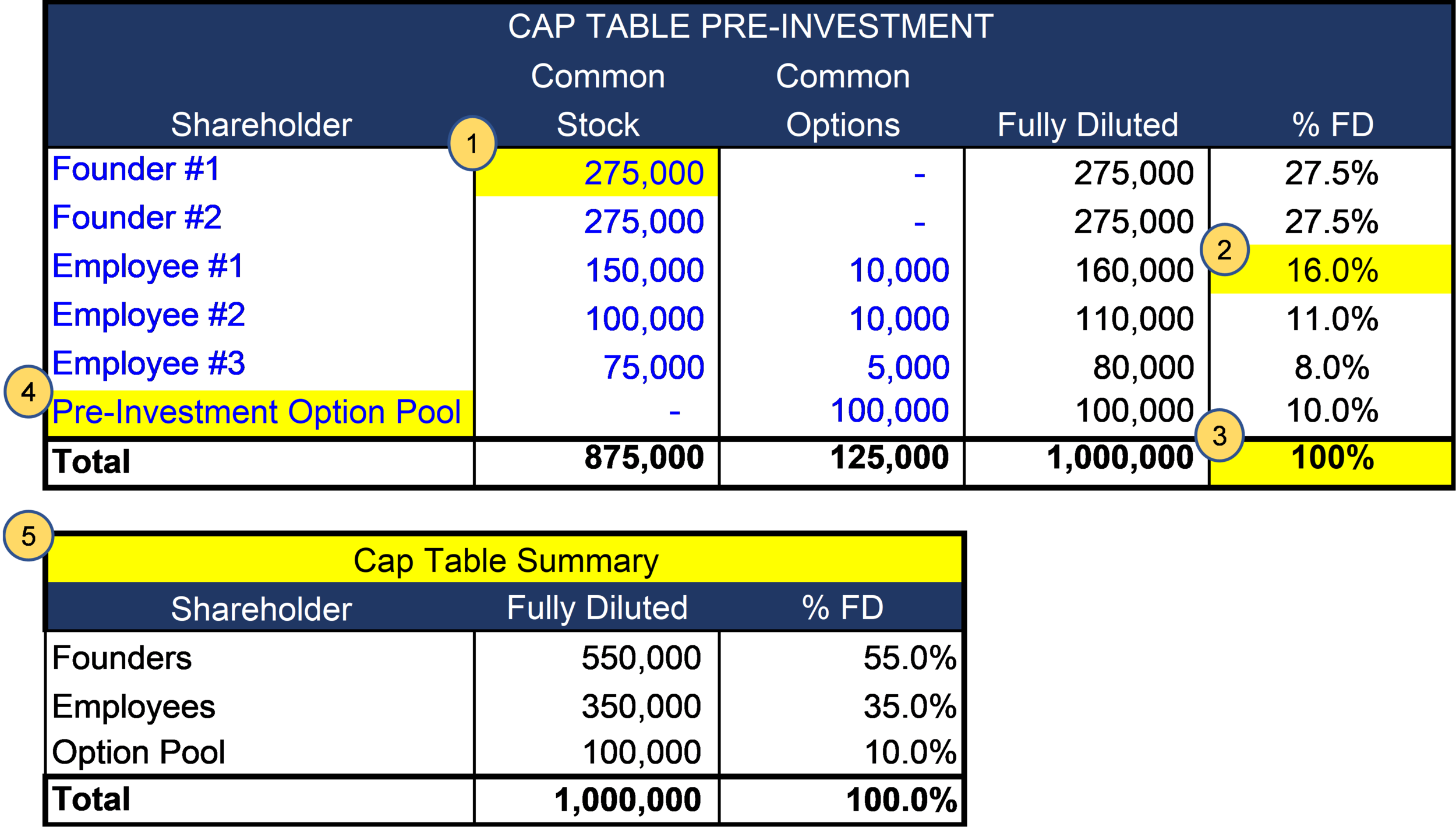

Prior to receiving its first investment, our imaginary startup has 2 founders, 3 employees, and an option pool of 100,000 common shares. Each employee has been awarded stock options, but the founders currently do not have any stock options.

For this post, I’d like to focus on the five highlighted cells in the image above.

[1] — Unlike venture capitalists and angel investors, startup founders and employees are typically awarded common stock instead of preferred stock. This means that investor shares are higher in the capital stack. When a liquidity event occurs (the startup is acquired or goes public), investors get paid in preference to the founders’ and employees’ common stock. In this scenario, founder #1 owns 275,000 common shares.

[2] —Employee #1 owns 16% of the the common stock on a fully diluted basis. This employee currently owns 150,000 common shares, but she also has 10,000 common options. In a fully diluted scenario, we simply assume that each employee will exercise their options, which dilutes (e.g., lessens) each person’s ownership percentage of the company.

In more complicated scenarios, a fully diluted calculation also includes preferred stock, stock warrants, and convertible debt as if each security is converted into common stock. However, for our purposes, we’ll keep it simple. Just know that these additional scenarios will likely be present as well in the company’s future.

[3] — This percentage should always equal 100% when the percentages above it are totaled. If not, the “Fully Diluted” column contains some sort of error. Always check this percentage before continuing to edit to the cap table.

[4] — Founders may choose to establish an option pool (shares set aside to be given to future employees as a part of their compensation package) upon the formation of the startup. If one does not exist, the first investor in the company will almost always make you create one. In future posts, I will illustrate an increase in the option pool when it is demanded by the Series A investor.*

[5] — This table summarizes the detailed table above. It simply shows how ownership in the company is split between founders, employees, and the current option pool. Cap tables come in many shapes and sizes, and this is one helpful option you may choose to add to your records.

As a side note, always know whether the increase in the option pool is done prior to the investment or after the investment. If it it done prior, the investors earn better economics for themselves. Brad Feld’s and Jason Mendelson’s Venture Deals has a great discussion on the topic.

That wasn’t too bad, right? Now, I’ll move to Part 2 of the Series, in which I’ll discuss the startup’s first investment in the form of a convertible note. For some additional reading, I’ve also written about convertible notes in the past.